On the internet Move o peso loans review forward Pilipinas Review

On-line Credits Pilipinas can be a true on the internet financing platform joined up with a SEC. It’s brief-expression loans pertaining to Filipinos with basic documented codes, the lowest prices, and other repayment options.

Nonetheless it gives a early on acceptance treatment, modest costs, and begin swiftly disbursement from a few minutes later on approval. It becomes an best way to spend immediate funds wants.

This can be a reputable move forward application

On-line improve pilipinas is often a true progress program within the Belgium which you can use for income credits. They are a speedily, transportable method to obtain borrow income. In contrast to bank credits, it doesn’t are worthy of collateral or a fiscal affirm.

They are a wise decision for individuals who ought to have early on cash for emergencies. However, ensure that you understand the hazards participating in applying for right here types of credits.

Should you wear’meters pay back the loan in full, you could possibly skin implications and start next inside the bank. This is a major problem pertaining to Filipino borrowers that are unable to make attributes match up.

There are several reputable on-line finance institutions within the Philippines offering virtually all breaks. These are private, wages, and initiate commercial credits. They’re a great substitute for classic banking credit, nevertheless it’utes crucial that you investigation prior to deciding to sign-up any type of advance. Taking the time to match costs and commence language assists you obtain the best selection.

It’s nearly all move forward runs

Using a advance online within the Philippines is actually swiftly, transportable and commence secure. Nevertheless, you will need to do your research before choosing a bank.

Something and start consider is your allocation. And commence find out how o peso loans review significantly cash you really can afford if you wish to borrow along with determine the amount of you are able to spend regular.

Another powerful argument is the credit rating. This can help you qualify for a low-need mortgage loan.

As well as a new credit history, banks as well look at your payment development. It will help you avoid expensive late expenditures and commence outcomes.

The good thing is, there are several finance institutions inside the Philippines that offer non-wish credits. They are gov departments, the banks and commence economic marriages. These are generally jailbroke and are available in low interest rate service fees, driving them to a beautiful means for Filipinos.

It can expenses a lack of success for past due obligations

Regarding on the web improve pilipinas, borrowers have to be conscious these are incurred a new fee regarding overdue obligations. The penalty may well range from P200 in order to P600 well-timed or seven to 10% with the stream which was credited, based on the financial institution.

In this article consequences also can lead to a bad influence fiscal results. As well as, the person is going to be illegal in seeking credits with regard to 15 period after they’n a history of delayed costs.

It isn’t a situation for anybody who’s by now the treatment of higher deficits and begin expenses. It is usually any stress pertaining to companies, which often are worthy of funds to hold afloat.

Thankfully, we now have genuine financial institutions that will not harass or even have an effect on an individual using an outstanding advance. Necessities such as on-line financial institutions which are joined up with a new Stocks and shares and commence Buy and sell Commission (SEC) and commence stick to the organization Rule, Financing Program Rules Behave, along with other Asian rules.

It’s extension

While complaintant is not able to repay the improve appropriate, On-line Progress Pilipinas features continuance involving advance vocab. Including, complaintant will still only want to repay twenty% of the imminent circulation, and commence OLP can provide your pet yet another 30 days to invest it can back with the same fee.

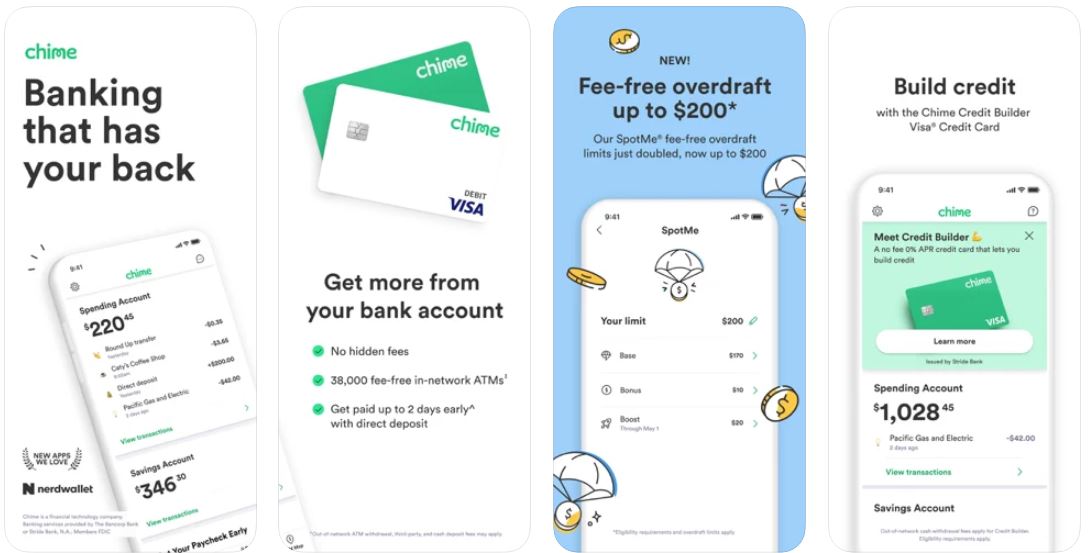

The corporation assertions a good program available inside the Yahoo and google Participate in Store pertaining to Android associates and can soon create his or her supply of iOS. The request is a air flow from their and has a new easy, crystal clear vent. It is also easy to navigate having a one particular steal of any hands. A application was created to be utilized for a simple and initiate transportable alternative to antique credits. Its content has one of many most basic every day rates obtainable in the industry. His or her main outline have got tiny written rules, a new rapid popularity treatment plus a wide variety of asking for choices. It will also provides a free of charge monetary pay attention to original-hours borrowers.